child tax credit after december 2021

Find out if they are eligible to receive the Child Tax Credit. 2022soon after the final payments were deposited on December 15 2021.

Final Check Child Tax Credit Payment For December Youtube

Big changes were made to the child tax credit for the 2021 tax year.

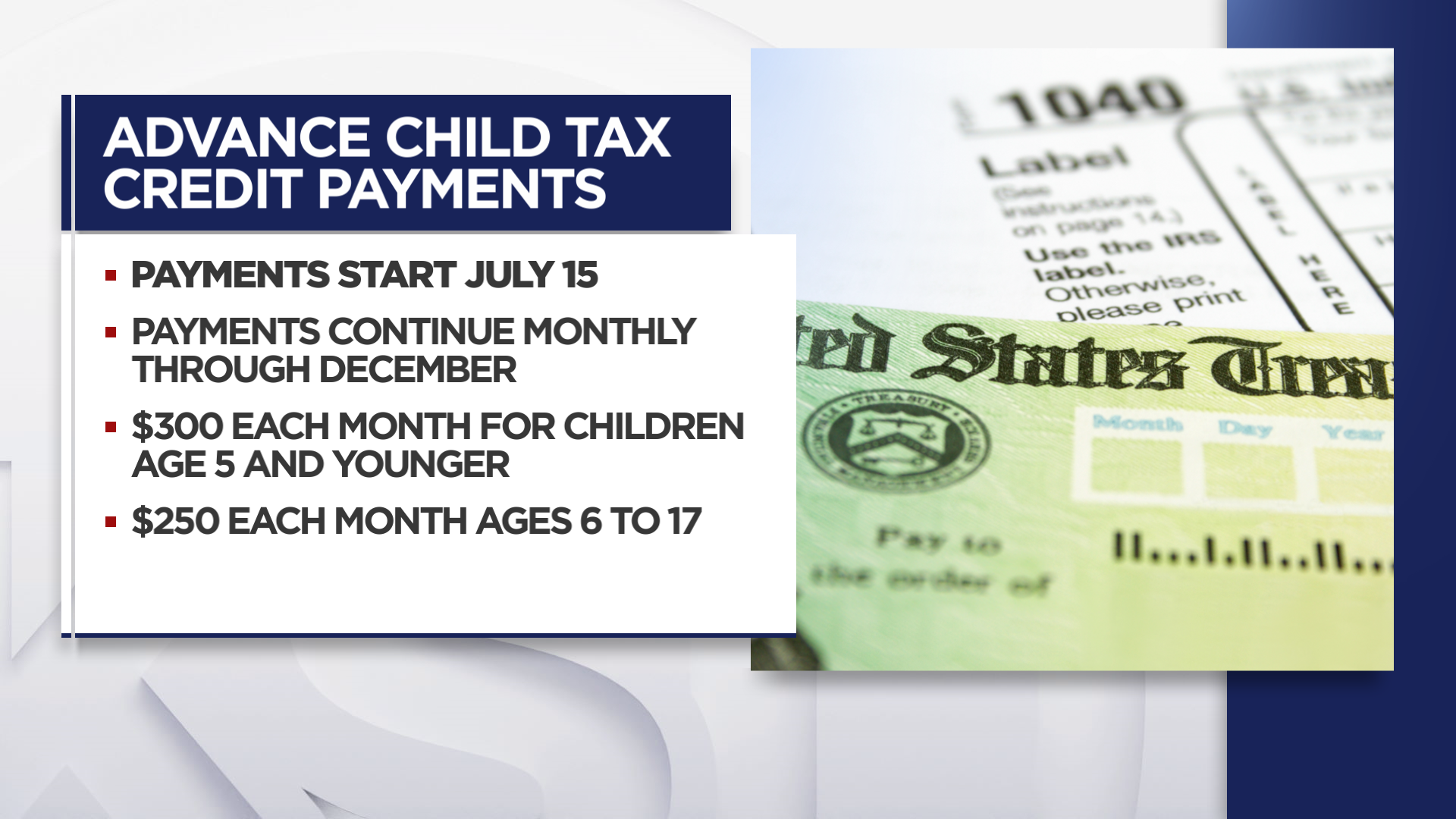

. If you received your first payment in December you got up to 1800 for each child age 5 and under and 1500 for. A childs age determines the amount. The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the amount of the Child.

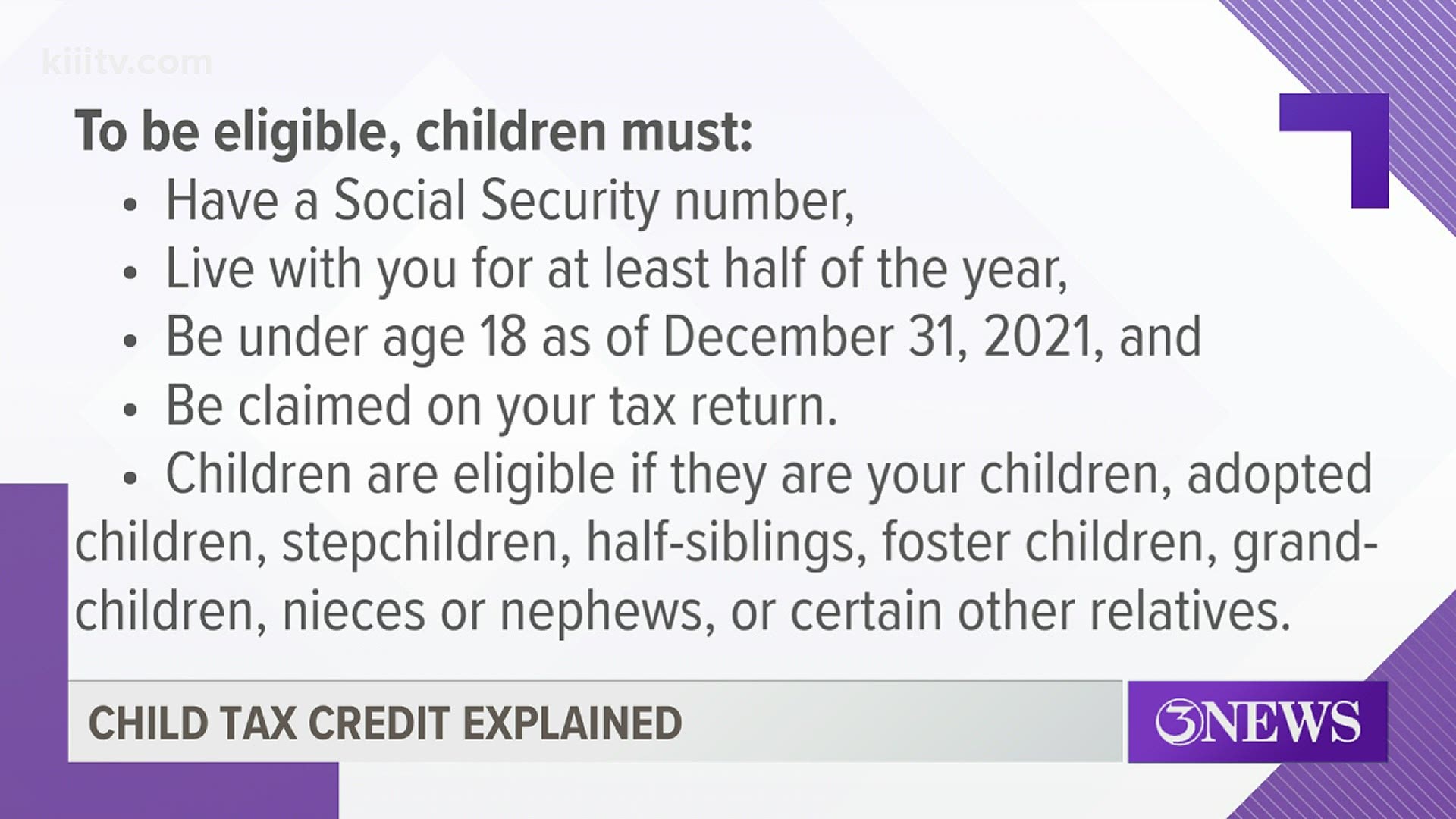

Schedule of 2021 Monthly Child Tax Credit Payments. Understand how the 2021 Child Tax Credit works. For 2021 the American Rescue Plan increased the maximum child tax credit from 2000 to 3000 for each child aged 6 to 17.

Last updated April 05 2022. The program which made the tax credit fully refundable expanded the tax. Get the Child Tax Credit.

The child tax credit amount for 2020 was 2000. The new 2021 US. The next child tax credit check goes out Monday November 15.

By The Kiplinger Washington Editors. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families. It helped roughly 60 million children and helped cut child.

If you enroll in a Medicare Advantage plan with this benefit the. For 2021 eligible parents or guardians. 2021 though you can still collect the remaining half of your credit either 1800 or 1500 when you file.

Child Tax Credit payments were received monthly by eligible families from July to December 2021. 2 days agoNew data proves how well it worked. Understand that the credit does not.

In this report we compare the employment well -being and financial security outcomes of families before and. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. Advanced child tax credits are expected to end in Dec.

Census Supplemental Poverty Measure report shows that the 2021 child tax credit reduced child poverty by 46. The Medicare Giveback Benefit is a Part B premium reduction offered by some Medicare Part C Medicare Advantage plans. The two most significant changes.

The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and.

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

December S Child Tax Credit Payment Is The Last One Unless Congress Acts Cnnpolitics

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

Child Tax Credit Eligibility Kiiitv Com

Last Day To Unenroll In July Advanced Child Tax Credit Payment

Families Can Now Register For Child Tax Credit Payments

Today S The Last Day To Opt Out Of The December Child Tax Credit Check What To Know Cnet

About The 2021 Expanded Child Tax Credit Payment Program

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

Child Tax Credit Talks Quietly Percolate Amid Advocates Push Roll Call

What You Can Expect From The December Child Tax Credit

Child Tax Credit Update Here S When You Will Receive The Final Payment Of 2021 Nj Com

Child Tax Credit Monthly Advance Payments To Start Arriving July 15

Child Tax Credit Faqs For Your 2021 Tax Return Kiplinger

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc