will child tax credit continue in 2022

For tax year 2022 the Child and Dependent Care Credit adjusts back to the pre-2021 provision and changes back to. However parents might receive one more big payment in April 2022 as part of last years plan.

Child Tax Credit 2022 How Much Will You Get

New research from the University of Michigan focuses on the effect of the 2021 Child Tax Credit on families living in poverty noting that the monthly payments reduced certain.

. 1 day agoThe Child Tax Credit really made a difference The year-to-year decline in child poverty was 45 percentage points the largest on record according to the left-leaning Center. October 6 2022 809 AM CBS Los Angeles. Parents get the remaining child tax credit on their 2021 tax returns.

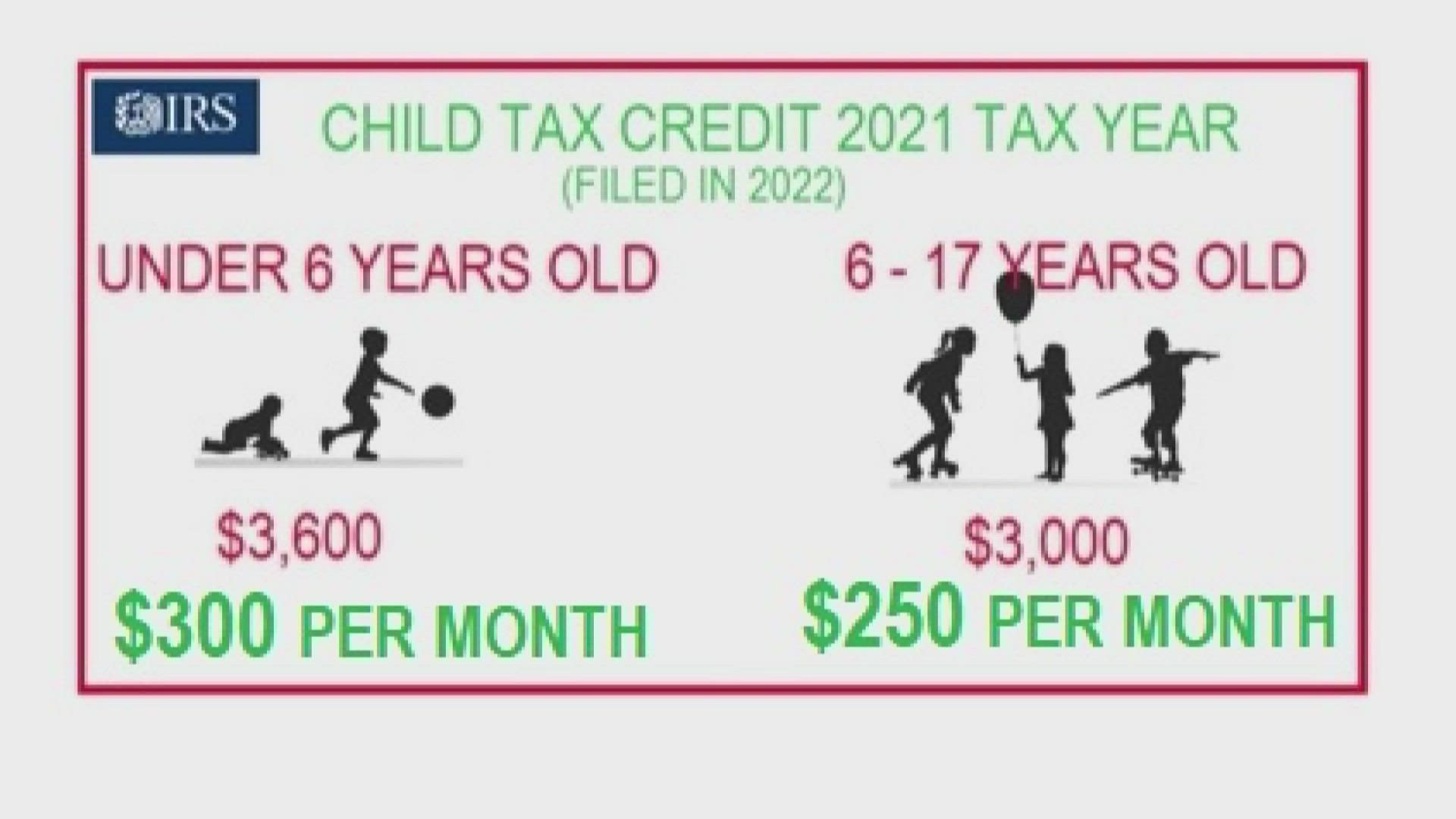

The law increased the annual child tax credit paid to parents from 2000 to 3000 per child and 3600 for children under age 6 and made the tax credit fully. Within those returns are families who qualified for child tax credits CTC. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. The existing credit of 2000 per child under age 17 was increased to 3600 per child. The new state program applies a.

2 days agoUpdated on. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022. Generally this is 1800 per younger child and 1500 per older child the nonprofit explains.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. This credit begins to phase down to 2000 per child once household income reaches 75000. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Access this secure website to check the status of your Child Tax Rebate with the Division of Taxation. To get to your Child Tax Rebate status you will need the following. Parents who did not opt out of the monthly payments will get 1500 or 1800 per child depending on the childs age after they file their taxes in the spring of 2022.

Up to 35 of 3000 1050 of child care expenses for a. That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17. Families with children under the age of six will receive a tax credit of 500 per child capped at a maximum family income of 80000.

While advocates must continue to push for an extension work can be done now to improve access to the existing credit for those who qualify. The benefit for the 2021 year is 3000 and 3600 for children under the age of 6. To be eligible for the full child tax credit single parents must have a modified adjusted gross income under.

Those who did not receive monthly payments in 2021 can file a tax return to get their. The payments wont continue in 2022 for the new year. 1 day agoThe child tax credit was temporarily expanded through the American Rescue Plan Act in 2021.

Time is running out to claim the expanded Child Tax Credit that could bring an eligible family as much as 3600 per. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan. For tax year 2021 the fully.

This means that the credit will revert to the previous amounts.

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Monthly Child Tax Credit Payments Have Ended And Their Future Is Unclear

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Get The Child Tax Credit Hawaiʻi Children S Action Network

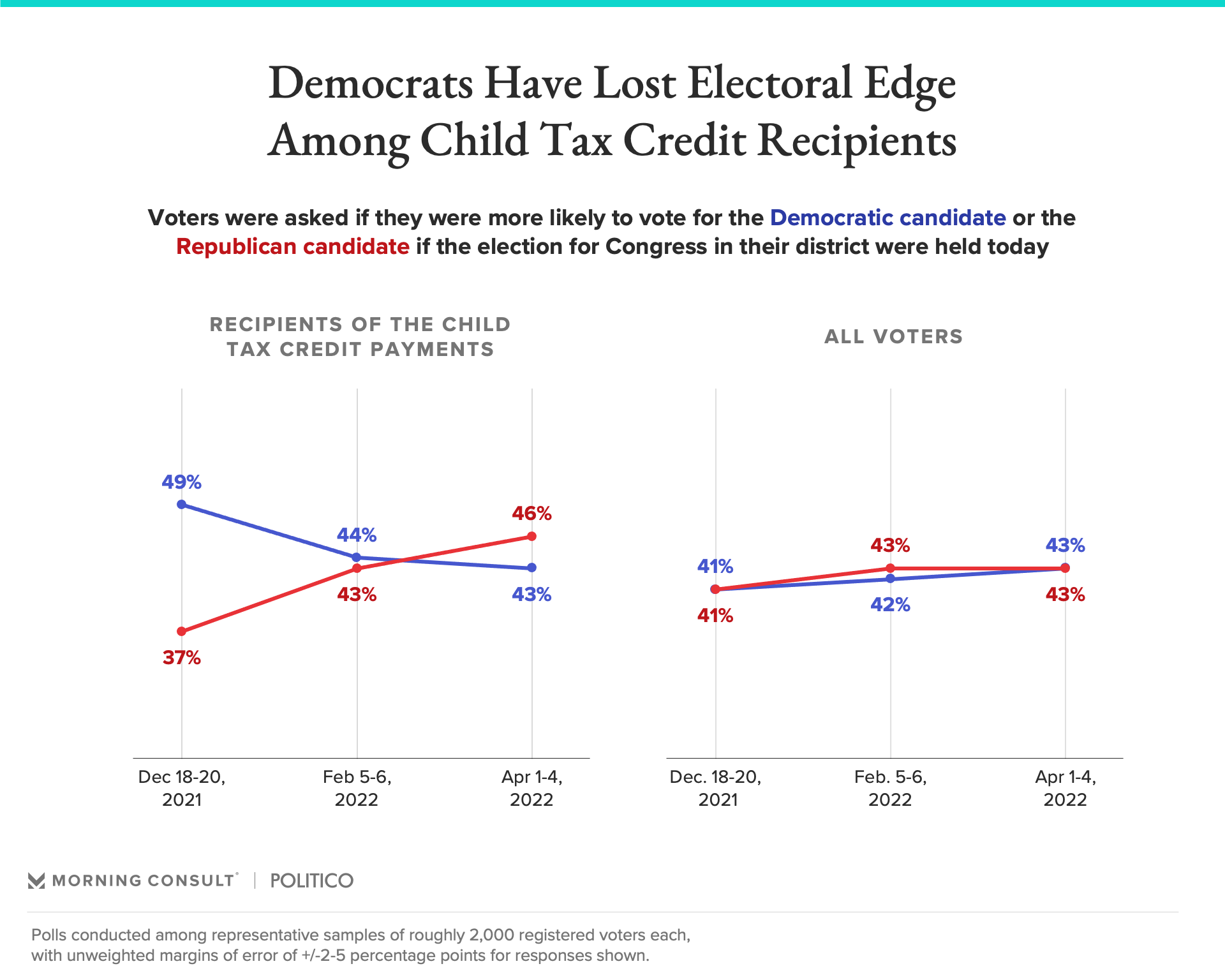

Republicans Favored To Win Senate Among Child Tax Credit Recipients

Legislative Momentum In 2022 New And Expanded Child Tax Credits And Eitcs Itep

Will 3 600 Child Tax Credits Continue Until 2025 Here S All You Need To Know After Biden S Congress Address The Us Sun

Child Tax Credit Did Not Come Today Issue Delaying Some Payments King5 Com

The 8 000 Child Tax Credit That Many Parents May Not Know About Cbs News

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Stimulus Check Update These Families Will Get 3 600 In 2022 Wbff

Widely Supported Child Tax Credit Is Associated With Greater Trust Of Democrats Common Dreams

Parents Can No Longer Count On Monthly Child Tax Credit Payments

Bonamici Pushes For Child Tax Payments To Continue In 2022 Koin Com

The Child Tax Credit What S Changing In 2022 Northwestern Mutual

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

2021 Child Tax Credit Definition Faqs How To Claim Nerdwallet